PRESS RELEASE

Issued by: Arconic Corporation

Arconic Corporation (“Arconic” or the “Company”) and Apollo today announced that Apollo Funds have completed the previously announced acquisition of the Company, which includes a minority investment from funds managed by affiliates of Irenic Capital Management (“Irenic”). The Company will continue to operate under the Arconic name and brand.

Tim Myers, Arconic Chief Executive Officer, said, “The closing of this transaction with Apollo Funds brings new perspective combined with deep industry expertise that will benefit our customers, employees, investors, and the communities where we operate. With them by our side, we will build on our position as a leading supplier of aluminum products and architectural solutions which provide sustainable value to our customers in the industries we serve.”

Apollo Partners Gareth Turner and Itai Wallach said, “We are pleased to complete this acquisition and look forward to leveraging our extensive experience in the aluminum fabrication sector to support the entire Arconic team as a portfolio company of Apollo Funds. We believe Arconic's world-class manufacturing capabilities, metallurgical expertise and talented team position it for continued momentum and success in this next chapter of the Company's evolution.”

Transaction Details

Pursuant to the terms of the transaction, affiliates of the Apollo Funds and Irenic, as well as co-investors, acquired all of the outstanding shares of Arconic stock. Shareholders are entitled to receive $30.00 per share in cash for each share of Arconic (ARNC) common stock owned. As a result of the transaction completion, Arconic's common stock no longer trades on the New York Stock Exchange.

Advisors

Evercore Group L.L.C. and Goldman Sachs & Co. LLC served as financial advisors to Arconic, and Wachtell, Lipton, Rosen & Katz served as legal counsel to Arconic.

J.P. Morgan Securities LLC and Wells Fargo Securities, LLC acted as co-lead financial advisors to Apollo. BMO Capital Markets, Mizuho Securities USA LLC and TD Securities also served as financial advisors to Apollo.

Paul, Weiss, Rifkind, Wharton & Garrison LLP served as legal counsel to the Apollo Funds.

Willkie Farr & Gallagher LLP and Lowenstein Sandler LLP served as legal counsel to Irenic.

| Contact details from our directory: | |

| Arconic Corporation | Aluminium |

| Related directory sectors: |

| Metals |

Weekly news by email:

See the latest Bulletin, and sign up free‑of‑charge for future editions.

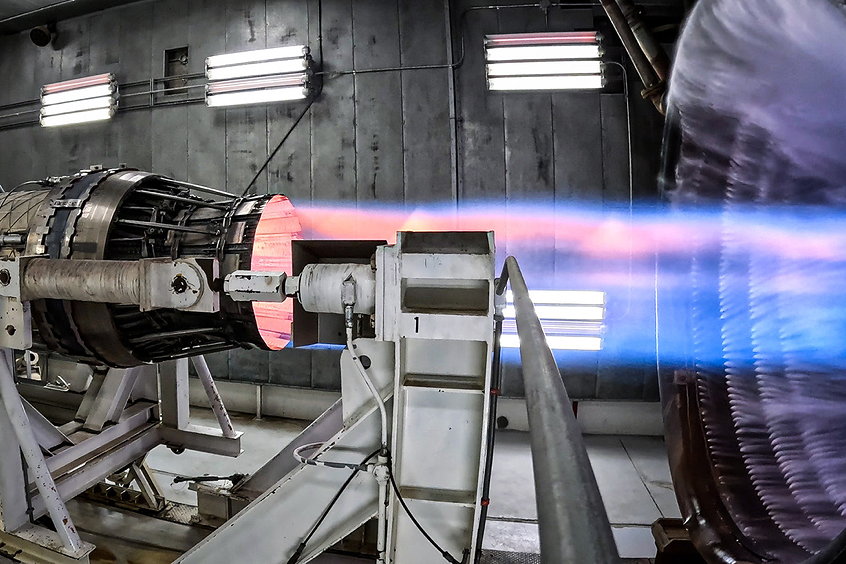

Hermeus begins precooler testing with P&W F100 engine

Citation Ascend programme advances with certification tests and flight testing

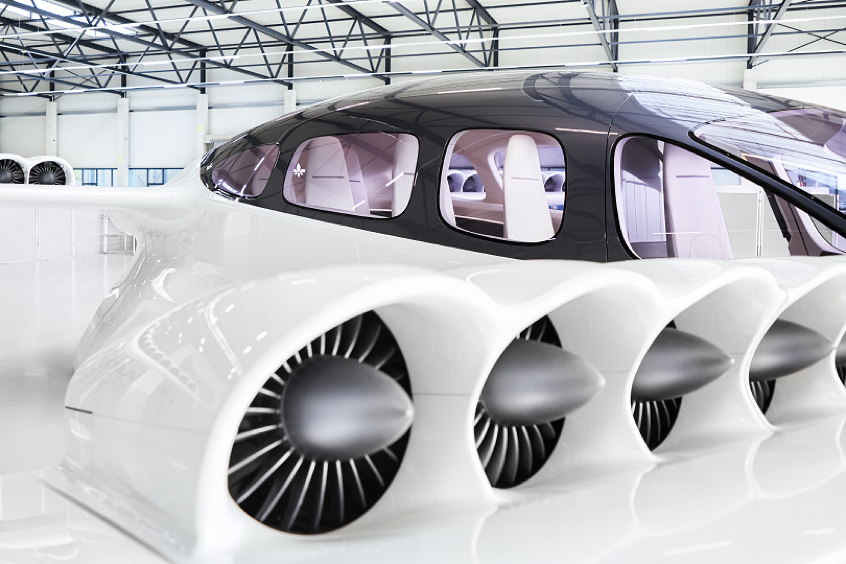

Lilium to expand industrial footprint in France