PMGC Holdings Inc., a diversified public holding company announced that it has completed the acquisition of SVM Machining, Inc..

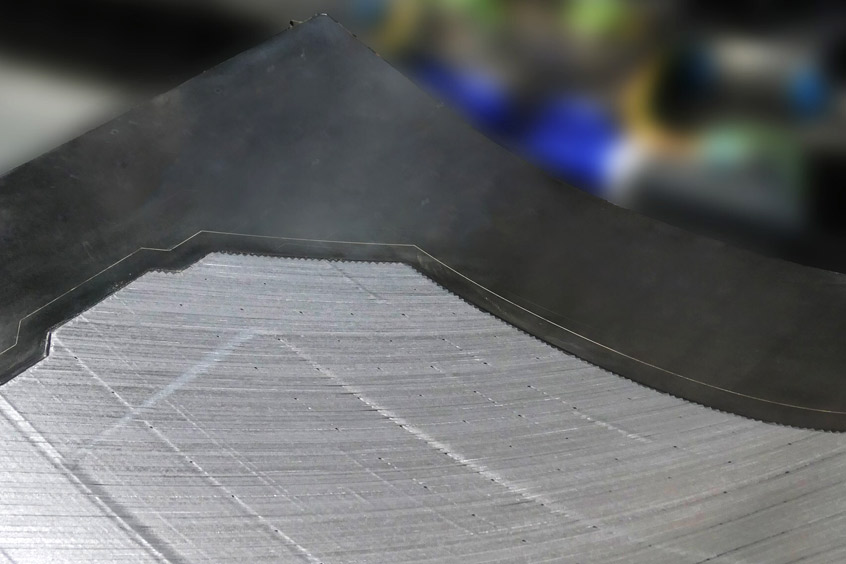

Founded in 1997 by Mark Serpa, SVM (aka Silicon Valley Manufacturing) is a Northern California-based ISO 9001:2015 Certified CNC precision machining and manufacturing services company serving medical, aerospace, biotech & pharmaceutical, semiconductor, and transportation markets.

This transaction represents PMGC’s third California based CNC machine shop acquisition to date, expanding PMGC’s growing footprint in precision manufacturing and furthering its strategy to assemble a multi-site machining platform serving aerospace, defence, medical and industrial industries.

SVM Overview

SVM is a precision manufacturing partner specializing in custom CNC-machined components, delivering high-quality, engineered solutions for customers in the following industries:

- Medical (including surgical robotics components)

- Aerospace (including satellite/spaceflight, UAV components)

- Biotech & Pharmaceutical (including lab automation and analytical instruments)

- Semiconductor (including wafer handling fixtures and cleanroom-compatible components)

- Transportation (including automotive and specialty vehicle parts)

- For the fiscal year ended December 31, 2024, SVM reported revenue of $3,042,701.

Summary of Material Transaction Terms

PMGC acquired 100% of the issued and outstanding shares of SVM from the seller, on a cash-free, debt-free basis.

- Base Purchase Price: $2,250,000 in cash, consisting of $2,000,000 paid at closing and a $250,000 indemnification holdback retained by PMGC at closing.

- Cash / Working Capital Mechanics: Purchase price includes a defined Final Cash Balance and a net working capital adjustment relative to a “Net Working Capital Target.”

- Earnout Consideration: In addition to the base purchase price, the seller may be entitled to receive contingent earnout consideration based on SVM achieving certain defined revenue performance levels during a specified post-closing measurement period.

- Timing of Earnout Payment: Any earned earnout amounts, if applicable, would be payable within 10 days following PMGC’s filing of its Form 10-K for the fiscal year that includes the applicable earnout measurement period.

| Contact details from our directory: | |

| Silicon Valley Manufacturing (SVM Machining, Inc.) | Computer-aided Engineering, Milling, Turning, Precision Machined Parts, Prototyping, Machining Services |

| Related directory sectors: |

| Machining |

| Computer Integrated Manufacturing |

Weekly news by email:

See the latest Bulletin, and sign up free‑of‑charge for future editions.

Horizon partners North Aircraft Industries on Cavorite X7 wing

Airbus and DSTA validate HTeaming with H225M and Flexrotor trials

Toray earns NCAMP qualification for toughened 3960 prepreg