Skyworks, a global leader in high-performance analog and mixed-signal semiconductors, and Qorvo, a leading global provider of connectivity and power solutions, today announced that they have entered into a definitive agreement to combine the two companies in a cash-and-stock transaction that values the combined enterprise at approximately $22 billion to create a U.S.-based, global leader in high-performance radio frequency (RF), analog and mixed-signal semiconductors.

“This combination marks an important milestone for our industry and for Skyworks,” said Phil Brace, chief executive officer and president of Skyworks. “Combining Skyworks’ and Qorvo’s complementary portfolios and world-class engineering teams will strengthen our ability to meet growing customer demand across mobile and diversified Broad Markets. With enhanced scale, a more diversified customer base and operational synergies, we can bring even greater innovation to our customers and sustainable value to our shareholders.”

“Qorvo and Skyworks share a culture of innovation and a commitment to solving our customers’ most complex challenges,” said Bob Bruggeworth, chief executive officer and president of Qorvo. “Together with Skyworks, we can accelerate innovation and deliver broader and more comprehensive solutions across numerous growth areas. We are excited to leverage the combined strengths of our teams and product and technology portfolios to build on our capabilities in Mobile and significantly expand our presence in defense and aerospace, edge IoT, AI data center, automotive and other industries powered by secular growth trends.”

Strategic Rationale and Transaction Highlights

The transaction is expected to deliver significant long-term value for customers, employees, and shareholders.

Enhanced Scale and Financial Profile: With combined pro forma revenue of approximately $7.7 billion and Adjusted EBITDA of $2.1 billion, the combined company will be better positioned to compete against larger players – supported by a stronger, more balanced revenue base that enables more predictable performance, a more efficient cost structure and resilient cash generation through cycles.

Stronger Innovation Pipeline: The combination creates an innovative global RF, analog and power technology company that can provide customers with more highly integrated, complete solutions, as well as a broad range of products and technologies. The combined company will bring together world-class engineering talent, including approximately 8,000 engineers and technical experts, and over 12,000 issued and pending patents, enabling faster development of advanced, system-level solutions and unlocking new design-win opportunities to meet growing customer demand.

Creates $5.1 Billion Mobile Business: The combination brings together complementary RF technologies and best-in-class products, expanding opportunities in Mobile while driving greater revenue stability. The broader portfolio will enhance our competitiveness across platforms, deepen customer integration and diversify our technology base – while strengthening our position to address rising RF complexity.

Establishes $2.6 Billion Diversified Broad Markets Platform: The transaction creates a $2.6 billion Broad Markets platform with a growing and profitable TAM across defense & aerospace, edge IoT, AI data center and automotive markets. These markets are characterized by attractive secular growth trends, long product life cycles and favorable gross margins.

Advances Domestic Manufacturing Position and Improves Utilization: The combined company will strengthen its domestic production capacity and enhance its capital efficiency, supported by a robust network of supply chain partners to meet the needs of high-volume and highly specialized customers.

Immediately and Meaningfully Accretive: The transaction is expected to be immediately and meaningfully accretive to non-GAAP EPS post-close, with $500 million or more of annual cost synergies within 24-36 months post-close when the companies are fully integrated.

Transaction Details

Under the terms of the agreement, Qorvo shareholders will receive $32.50 in cash and 0.960 of a Skyworks common share for each Qorvo share held at the close of the transaction, which implies a combined enterprise value of approximately $22 billion.

Upon closing, Skyworks shareholders will own approximately 63 percent of the combined company, while Qorvo shareholders will own approximately 37 percent, on a fully-diluted basis. Phil Brace will serve as chief executive officer of the combined company; Bob Bruggeworth will join the Board of Directors of the combined company. The combined company's Board of Directors will comprise 11 directors, eight from Skyworks and three from Qorvo.

Skyworks plans to fund the cash portion of the transaction using a combination of cash on hand and additional financing. Skyworks has obtained debt financing commitments from Goldman Sachs Bank USA. The transaction is not subject to any financing conditions. The combined company's net leverage at closing is expected to be approximately 1.0x last-twelve-month Adjusted EBITDA. This favorable capital structure will allow for continued investments in the business to drive shareholder value.

Timing and Approvals

The Boards of Directors of both companies have unanimously approved the transaction, which is expected to close in early calendar year 2027, subject to the receipt of required regulatory approvals, approval of Skyworks shareholders and Qorvo shareholders and the satisfaction of other customary closing conditions. Starboard Value LP, an approximately 8 percent6 shareholder of Qorvo, has signed a voting agreement in support of the transaction.

Preliminary Financial Results

In a separate press release issued today, Skyworks announced preliminary financial results for its fourth quarter and full fiscal 2025. Skyworks’ preliminary results press release is available on the investor relations section of Skyworks’ website. As planned, Skyworks will issue a press release and host a conference call with analysts to share its full fourth quarter financial results on November 4, 2025.

Also, in a separate press release issued today, Qorvo announced preliminary results for its fiscal 2026 second quarter. Qorvo will announce fiscal 2026 second quarter financial results and host a conference call on November 3, 2025.

Conference Call Information

Skyworks and Qorvo will host a joint conference call today to discuss the proposed transaction. Investors can register to participate in the conference call. To listen to the live call and access the presentation materials, please visit Skyworks’ website or Qorvo’s website. A recording of the call will also be available on both companies’ websites today.

Advisors

Qatalyst Partners and Goldman Sachs & Co. LLC are serving as financial advisors to Skyworks; Skadden, Arps, Slate, Meagher & Flom LLP is serving as Skyworks’ legal advisor and FGS Global is serving as Skyworks’ strategic communications advisor.

Centerview Partners LLC is serving as exclusive financial advisor to Qorvo; Davis Polk & Wardwell LLP is serving as Qorvo’s legal advisor; and Joele Frank, Wilkinson Brimmer Katcher is serving as Qorvo’s strategic communications advisor.

| Contact details from our directory: | |

| SkyWorks Solutions, Inc. | Semiconductor Components |

| Qorvo, Inc. | Frequency Converters, DC Amplifiers, Radio & Intermediate Freq. Amplifiers, Electronic Switching Systems, Avionic Attenuators |

| Related directory sectors: |

| Avionic Components |

Weekly news by email:

See the latest Bulletin, and sign up free‑of‑charge for future editions.

Honeywell supplies LED landing search light for MV-75

Indra advances UAV collision avoidance with 360-degree detection trials

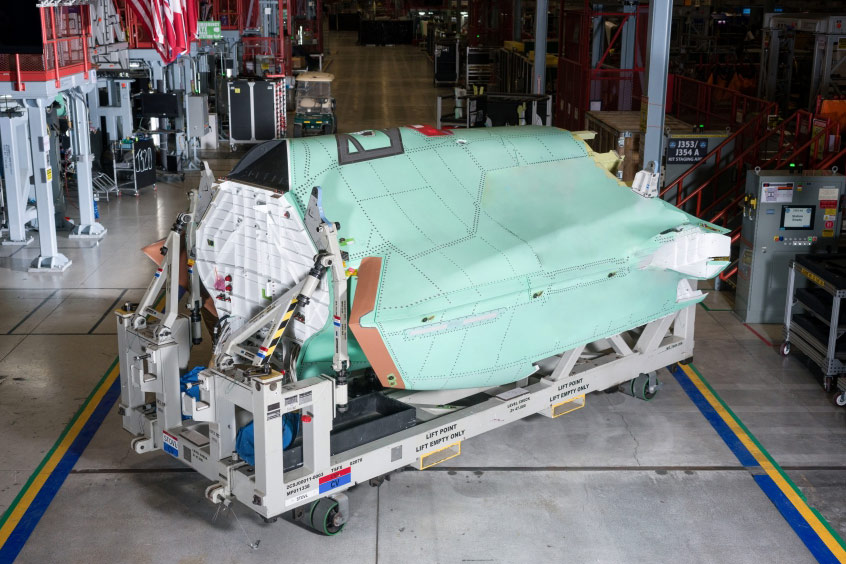

Northrop Grumman delivers 1,500th F-35 centre fuselage from Palmdale

Kratos expands in Birmingham with systems integration facility